India’s agricultural land values give us a hint about total land value

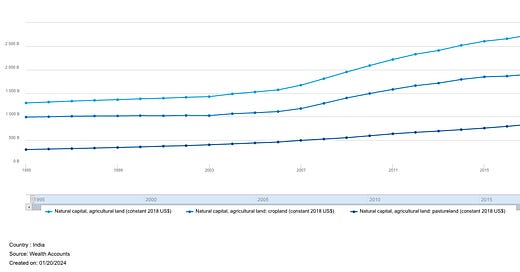

World Bank’s Wealth Accounts provide an estimate for India’s agricultural land value for various categories in 2018 USD:

World Bank’s estimate for total value of cropland and pastureland for 2018 was ~USD 2,070 per capita. This would make it about as large as the GDP in 2018 (current prices USD). So agricultural land value is about 1 times GDP. McKinsey’s estimate of the global average land value is about 2 times GDP. For the following two reasons, I think India’s land value would be easily closer to, or maybe more than, Australia (~3 times GDP) than the global average:

If we take both World Bank’s Wealth Accounts and McKinsey’s estimate to be true, non-agricultural land value of India would be (2-1 =) 1 times GDP while agricultural land value would be 1 times GDP. Land value is the net present value of expected future land rents. I think it is safe to assume that expected future rents from non-agricultural land would be much higher than agricultural land. Non-agricultural activities contribute more than 83% of India’s GDP and I think it is safe to assume that value-added from agricultural activities as a percentage of GDP would be lower in the future.

In a previous post, I discussed Free A Billion Pvt Ltd’s estimate for India’s surplus land held by the government. And I showed how it is, at the very least, about Rs. 88 lakh crores (1 lakh crore = 1 trillion). This was from 2018, when our GDP was about Rs. 183 lakh crores (assuming an exchange rate of 1 USD = Rs. 68). That is, surplus government land was about .5 times GDP, more than McKinsey’s estimate for total (not only surplus) government land. This further hints that the non-agricultural land value to GDP ratio of India would be higher than the global average.